Corniche Group manages the Farsi family’s investments, holdings, creative drive and philanthropic projects. It also acts as a platform to explore wider opportunities.

For the past 50 years, the Farsi family has been active in the arts, philanthropy, property development and urban planning across Europe and the Middle East. Led by Hani Farsi, Corniche continues the family’s work in these fields whilst driving innovation in areas such as IT and many other interests.

Continue ReadingThe activities of the Corniche group are managed by 4 distinct divisions. All operate independently while remaining true to the ethos and vision of the Farsi family name.

Aquaculture industry with Silver Bullet.

Corniche Investments is the private equity and investment arm of the Corniche Group. The Corniche Investments team are imbued with a passion for helping turn exciting ideas into market leading businesses and unearthing seed companies to propagate and nurture to bigger and better things.

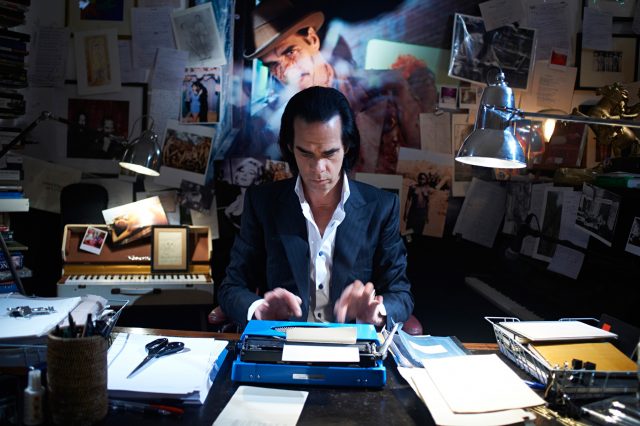

Nick Cave in '20,000 Days on Earth'.

Corniche Media encompasses film, television and theatre and is active in the financing, production and distribution of entertainment and content. Founded over 10 years ago, Corniche Media reflects a passion for impactful storytelling and a desire to bring culturally relevant tales to viewers through independent filmmaking.

Mada'in Saleh, Saudi Arabia.

Corniche Middle East and Africa is a key division in the Farsi family business based in Jeddah, Saudi Arabia. Established to build on and compliment the impressive legacy left by Mohammed Said Farsi’s work as a civic leader and philanthropist in the region Corniche Middle East is a dynamic and diverse business division.

Building a path to positive social and environmental change.

The Mohamed S. Farsi Foundation (MSFF) is a London based grant-making foundation funding charities and social enterprises around the world working in healthcare, education, international development, and arts & culture. Founded in 2009 by Hani M.S. Farsi to honour his father, Dr. Mohamed S. Farsi, and his lifetime of charitable work.